Free printable checkbook registers are essential for effectively managing your finances. In this article, we will explore the benefits of using these convenient tools and provide tips on finding, using, and customizing them to fit your needs. Get ready to take control of your financial transactions with ease and style!

Introduction to free printable checkbook registers

A checkbook register is a personal record-keeping tool used to track financial transactions related to a checking account. It serves as a ledger where individuals can record details of their deposits, withdrawals, and other related information.Keeping track of financial transactions is important for several reasons.

Firstly, it helps individuals maintain an accurate and up-to-date record of their account balance, allowing them to know how much money they have available at any given time. This is particularly useful in avoiding overdrafts or bounced checks.Furthermore, a checkbook register enables individuals to monitor their spending habits and identify areas where they may need to cut back or make adjustments.

By being aware of their financial transactions, individuals can better manage their finances and make informed decisions about their spending.Using a printable checkbook register offers various benefits. Firstly, it provides a convenient and accessible way to maintain a record of financial transactions.

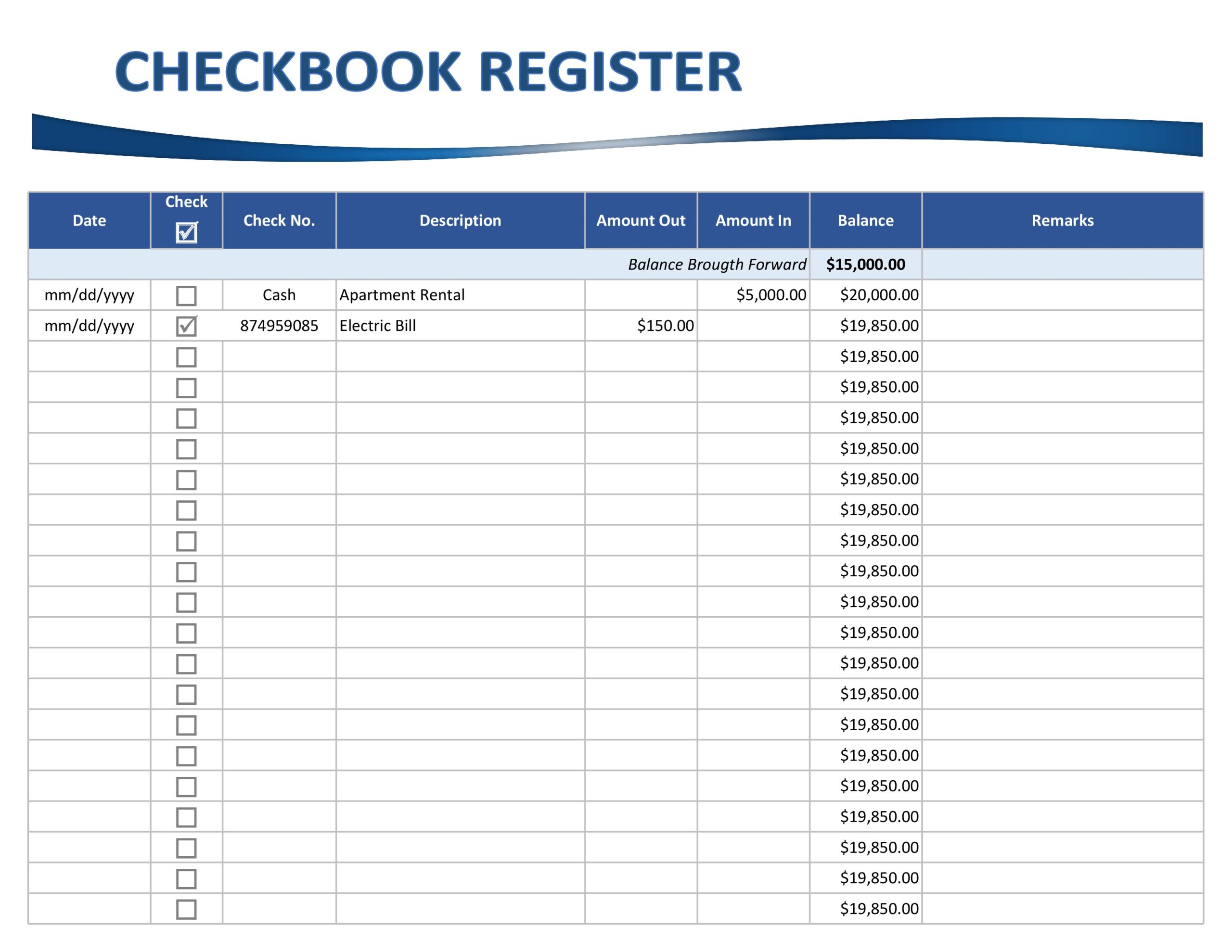

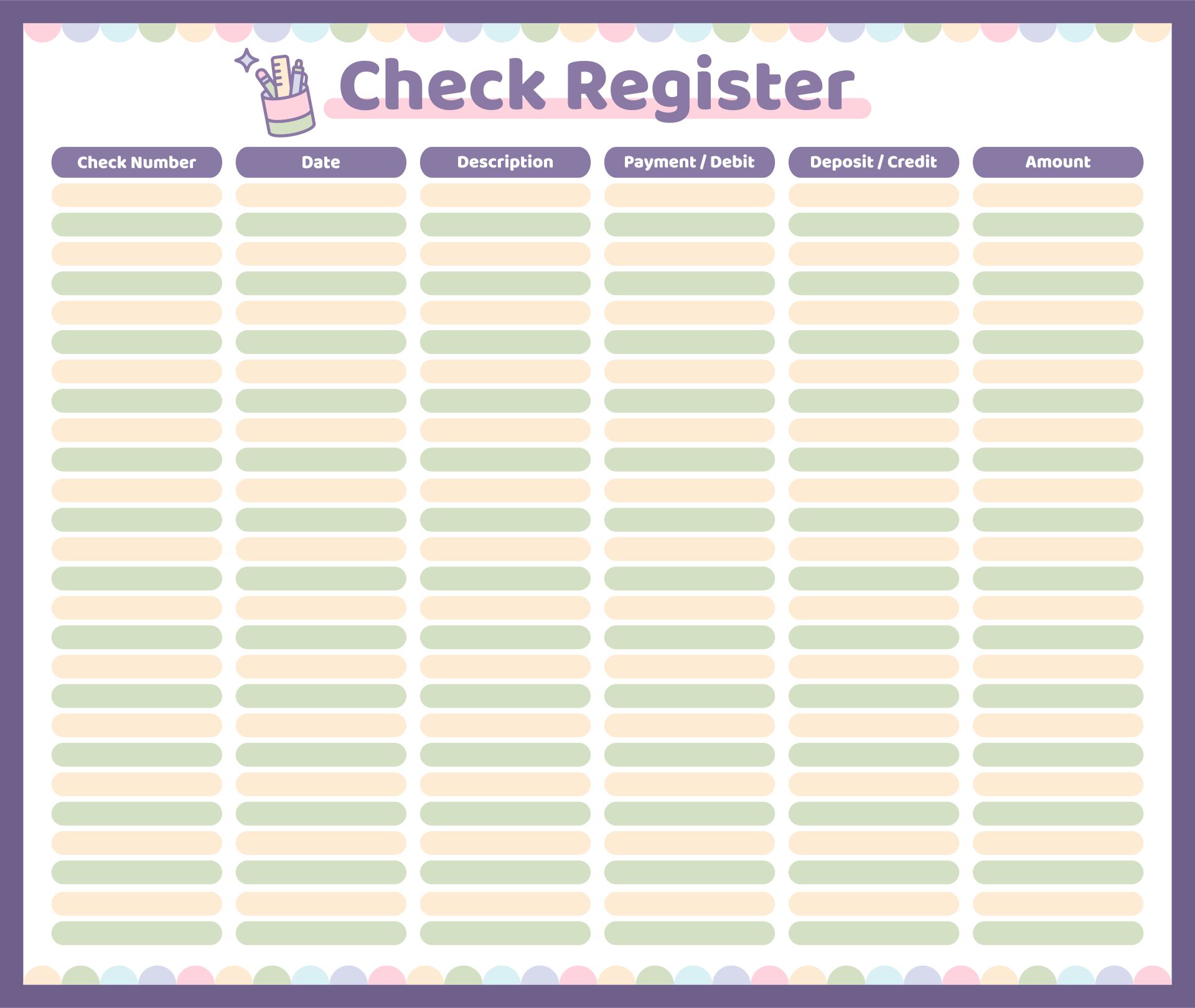

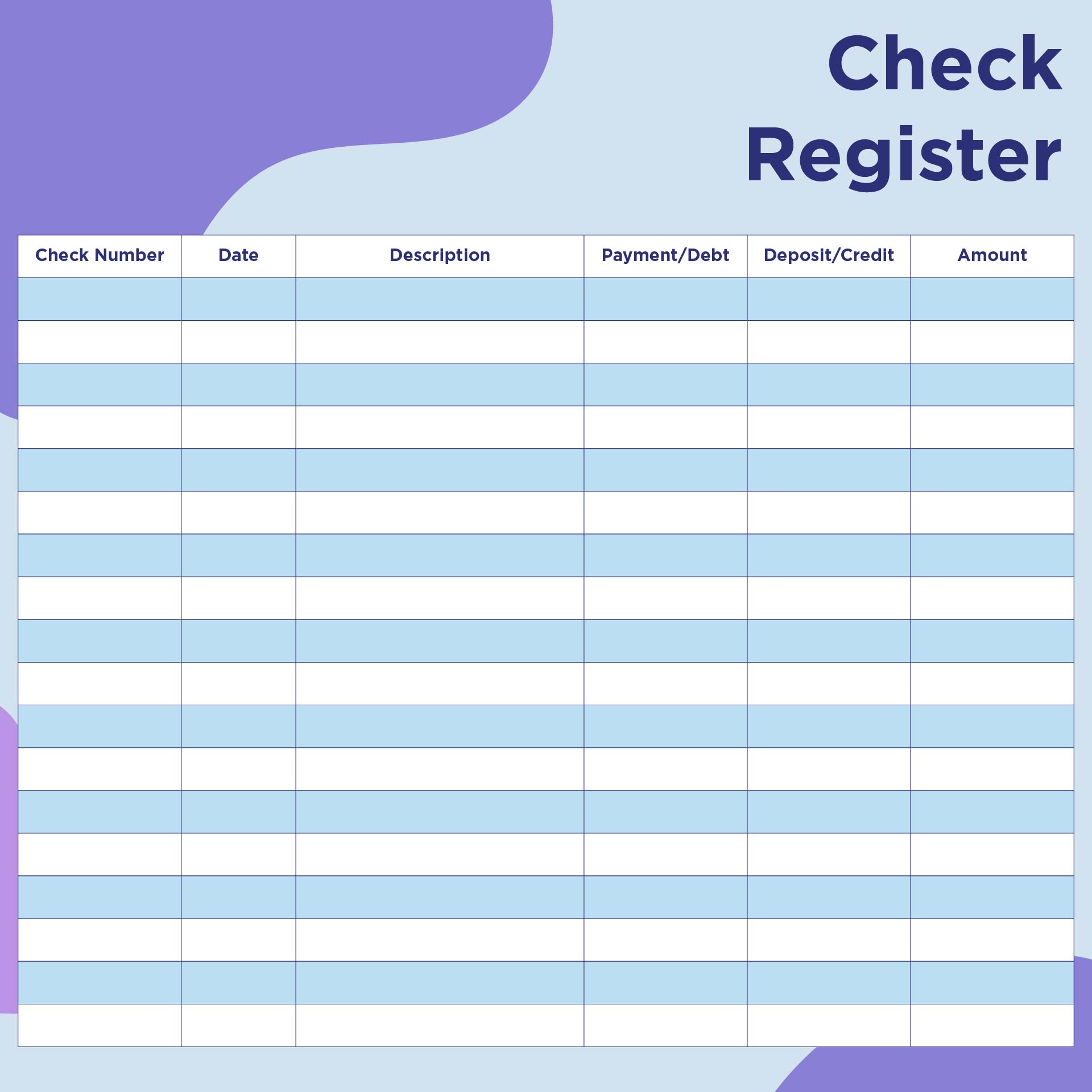

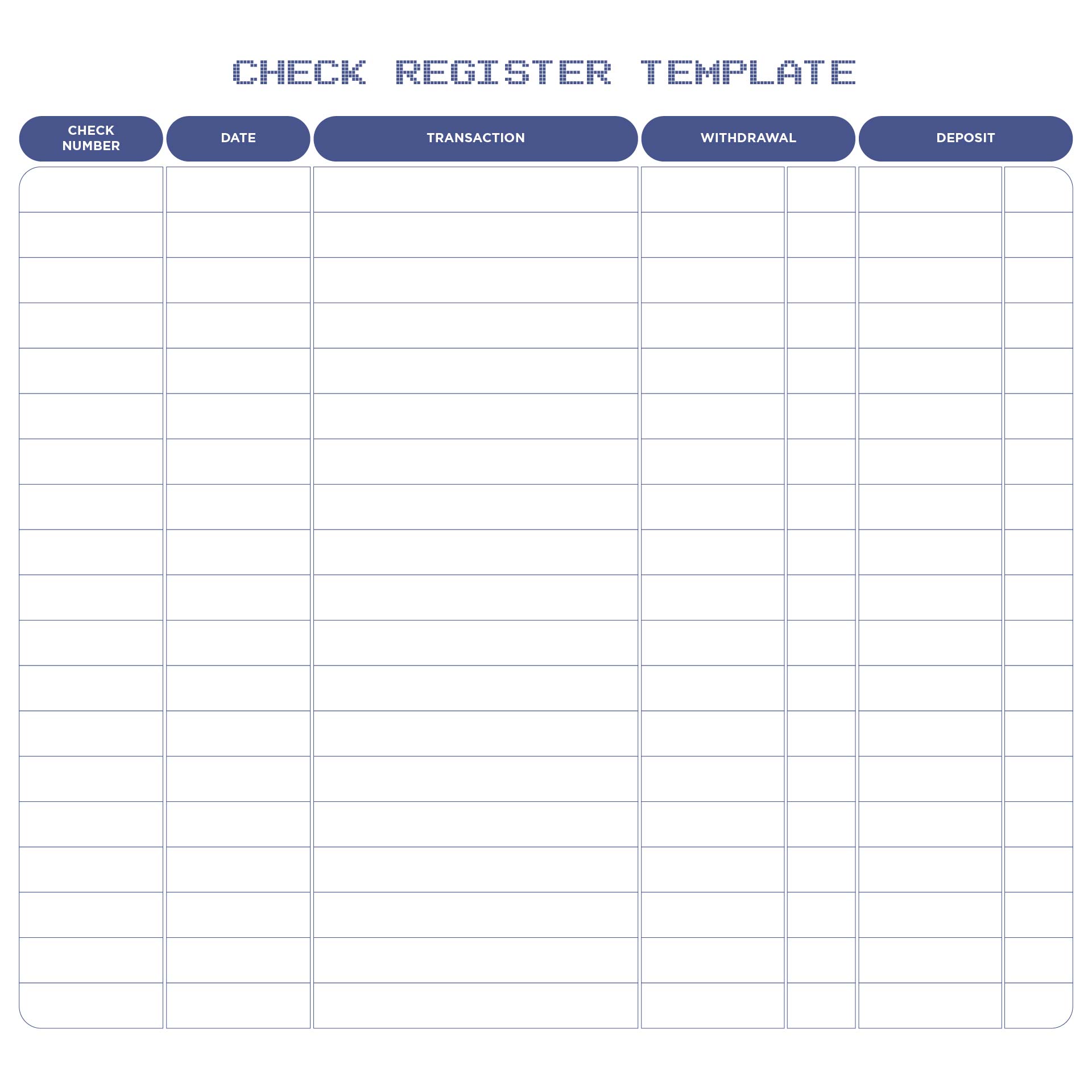

With a printable register, individuals can easily print out new pages whenever needed, ensuring that their records are always organized and up to date.Additionally, printable checkbook registers often come with pre-designed templates, making it easier for individuals to fill in the necessary information.

These templates typically include sections for recording the date, description of the transaction, amount, and running balance. This structured format helps individuals maintain clear and consistent records.By using a printable checkbook register, individuals can also reduce the chances of errors or discrepancies in their financial records.

The structured layout of the register ensures that all transactions are properly recorded, minimizing the risk of overlooking or misplacing important information.In conclusion, a checkbook register is a valuable tool for tracking financial transactions and maintaining an accurate record of one’s finances.

Using a printable checkbook register offers convenience, organization, and accuracy, making it an effective resource for individuals seeking to manage their finances effectively.

How to find free printable checkbook registers online

Finding free printable checkbook registers online is a convenient and cost-effective way to manage your finances. There are several websites that offer a wide range of designs and layouts for printable registers. Here are some tips on how to find them:

Identify websites that offer free printable checkbook registers

To start your search, you can use search engines like Google or Bing and enter s such as “free printable checkbook registers” or “printable checkbook registers.” This will provide you with a list of websites that offer these resources. Some popular websites that offer free printable checkbook registers include:

- www.vertex42.com

- www.printablepaper.net

- www.freeprintable.net

Discuss the advantages of using online resources for printable registers

There are several advantages to using online resources for printable checkbook registers. Firstly, it saves you the time and effort of having to create your own register from scratch. Secondly, online resources offer a wide variety of designs and layouts to choose from, allowing you to find one that suits your preferences and needs.

If you’re looking for some free Easter printable coloring pages, you’re in luck! We have a great selection of Easter-themed coloring pages that you can print out and enjoy. Whether you’re a kid or a kid-at-heart, coloring can be a fun and relaxing activity.

Our free Easter printable coloring pages feature cute bunnies, Easter eggs, and other festive designs. Simply click on the link to access the coloring pages and print them out. Grab your favorite coloring tools and let your creativity flow!

Additionally, online resources are easily accessible and can be printed whenever you need a new register.

Provide tips on how to search for specific designs or layouts

If you have a specific design or layout in mind for your checkbook register, you can refine your search by adding relevant s. For example, if you prefer a minimalist design, you can search for “free printable checkbook registers minimalist.”

You can also specify the size or format of the register, such as “free printable checkbook registers A4 size” or “free printable checkbook registers Excel format.”When searching for specific designs or layouts, it’s also helpful to browse through different websites and compare the options available.

Some websites may offer more customization features or a larger selection of designs. Additionally, you can read user reviews or comments to get feedback on the quality and usability of the printable registers.By following these tips, you can easily find free printable checkbook registers online that meet your needs and preferences.

Happy searching!

Different types of free printable checkbook registers

When it comes to free printable checkbook registers, there are several different types you can choose from. Each type has its own format and comes with its own pros and cons. Let’s take a closer look at the various formats available and discuss the advantages and disadvantages of each.

Single-entry checkbook registers

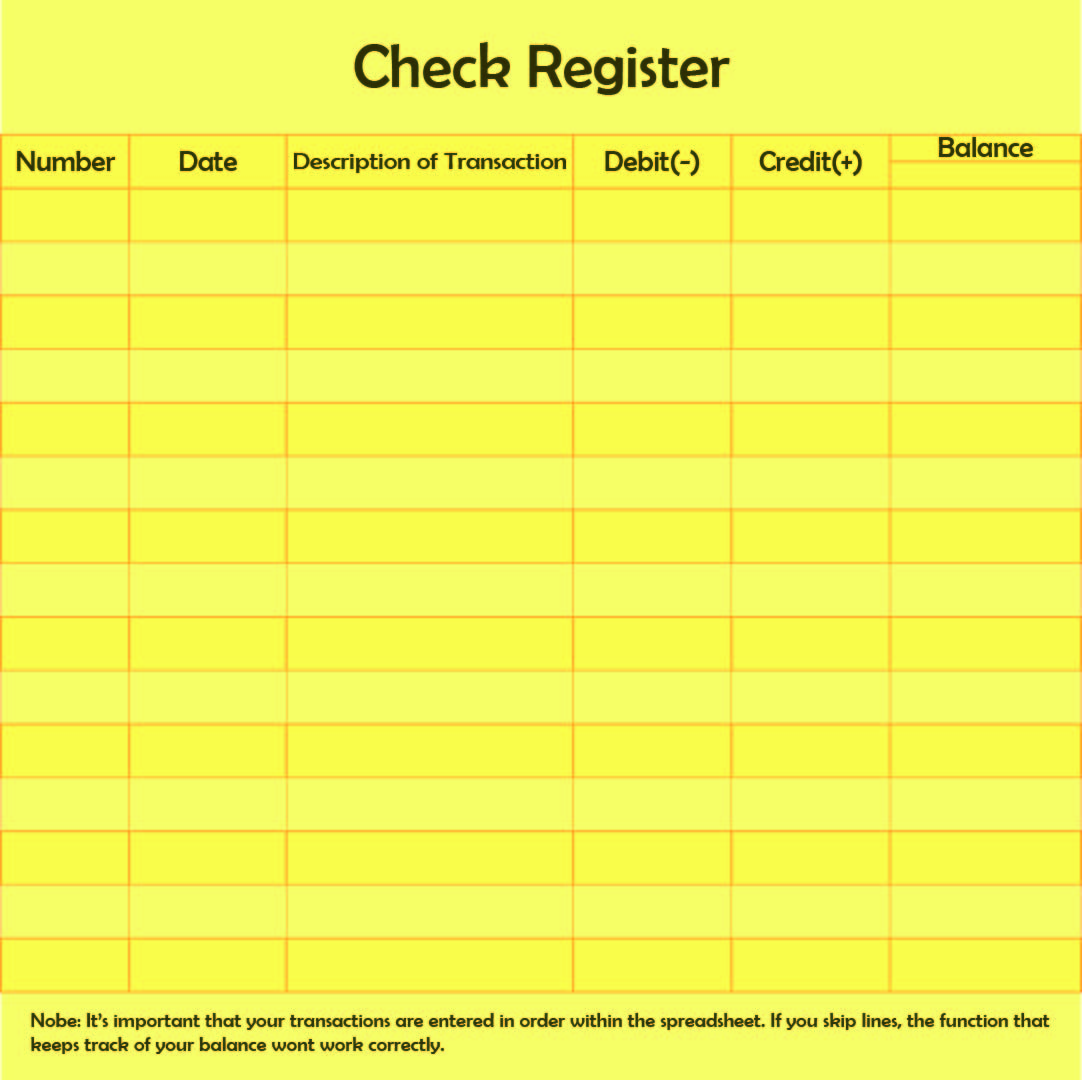

A single-entry checkbook register is a simple and straightforward format. It allows you to record each transaction in a single line, including the date, description, and amount. This type of register is commonly used for personal finances and small businesses.

If you’re a fan of Five Nights at Freddy’s (FNAF), we have the perfect activity for you. Check out our collection of FNAF printable coloring pages. These coloring pages feature your favorite characters from the popular video game franchise. From Freddy Fazbear to Foxy the Pirate, you’ll find them all in our FNAF printable coloring pages . Simply click on the link to access the coloring pages and print them out.

Get ready to bring these characters to life with your coloring skills!

Pros:

- Easy to understand and use

- Requires less time and effort to maintain

Cons:

- Does not provide a detailed breakdown of income and expenses

- May not be suitable for complex financial situations

Example of a single-entry checkbook register layout:

| Date | Description | Amount |

|---|---|---|

| 01/01/2022 | Gasoline | $50.00 |

| 01/02/2022 | Groceries | $100.00 |

Double-entry checkbook registers

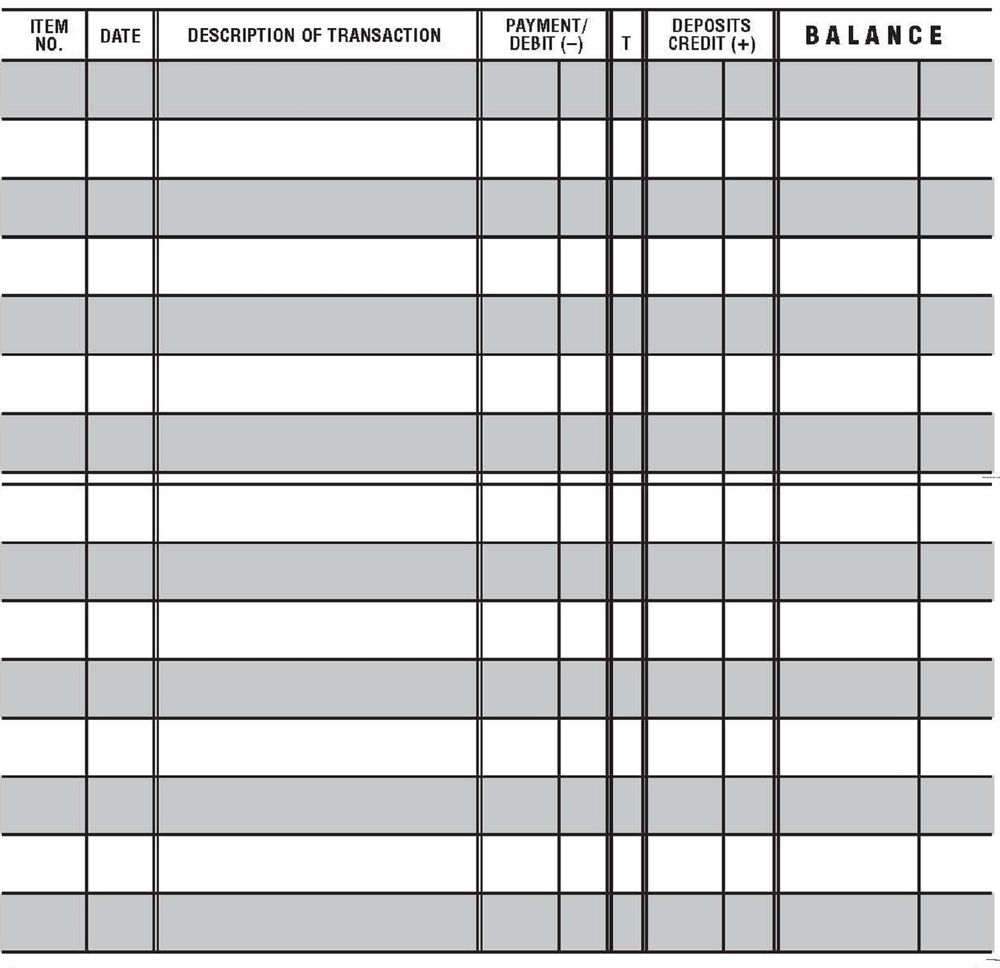

A double-entry checkbook register is a more comprehensive format. It follows the principles of double-entry bookkeeping, where each transaction is recorded twice – once as a debit and once as a credit. This type of register is commonly used by businesses and individuals with complex financial situations.

Pros:

- Provides a detailed breakdown of income and expenses

- Allows for better tracking of financial transactions

Cons:

- Requires more time and effort to maintain

- May be more complex for individuals with limited accounting knowledge

Example of a double-entry checkbook register layout:

| Date | Description | Debit | Credit |

|---|---|---|---|

| 01/01/2022 | Gasoline | $50.00 | |

| 01/02/2022 | Groceries | $100.00 |

These are just two examples of the different types of free printable checkbook registers available. The choice between single-entry and double-entry registers depends on your personal preference and the complexity of your financial situation. Consider your needs and choose the format that works best for you.

Tips for using a free printable checkbook register effectively: Free Printable Checkbook Registers

Using a free printable checkbook register can be a helpful tool in managing your finances. Here are some tips to help you use it effectively.

How to fill out the register correctly, Free printable checkbook registers

To fill out the register correctly, follow these steps:

- Start by recording the date of the transaction.

- Write the name of the payee or recipient of the transaction.

- Enter the amount of the transaction, whether it is a deposit or withdrawal.

- Record the category of the transaction, such as groceries, utilities, or entertainment.

- Calculate the running balance by adding or subtracting the transaction amount from the previous balance.

- Make sure to double-check your entries for accuracy.

The importance of regularly updating the register

Regularly updating the register is crucial to stay on top of your finances. Here’s why:

- It helps you keep track of your spending and income.

- It allows you to see where your money is going and identify areas where you can cut back.

- It helps you avoid overdrawing your account by ensuring you have enough funds to cover your expenses.

- It enables you to reconcile your bank statement and catch any errors or discrepancies.

- It provides a clear picture of your financial situation and helps you make informed decisions about your money.

Tips for organizing and categorizing transactions

Organizing and categorizing your transactions can make it easier to analyze your spending habits. Here are some tips:

- Create categories that are relevant to your spending patterns, such as food, transportation, and bills.

- Assign each transaction to the appropriate category to track your spending in different areas.

- Consider using subcategories within larger categories for more detailed tracking.

- Color-code or use symbols to visually distinguish different types of transactions.

- Regularly review and update your categories to ensure they still align with your current spending habits.

Remember, using a free printable checkbook register can help you stay organized and in control of your finances. By filling it out correctly, regularly updating it, and organizing your transactions effectively, you can gain valuable insights into your financial habits and make informed decisions about your money.

Customizing a free printable checkbook register

Once you have found a free printable checkbook register that suits your needs, you may want to personalize it to better fit your individual financial management preferences. Customizing a checkbook register allows you to tailor it to your specific requirements and make it more effective in tracking your expenses and managing your finances.

Here are some steps to personalize a printable register and the benefits of doing so:

How to personalize a printable register

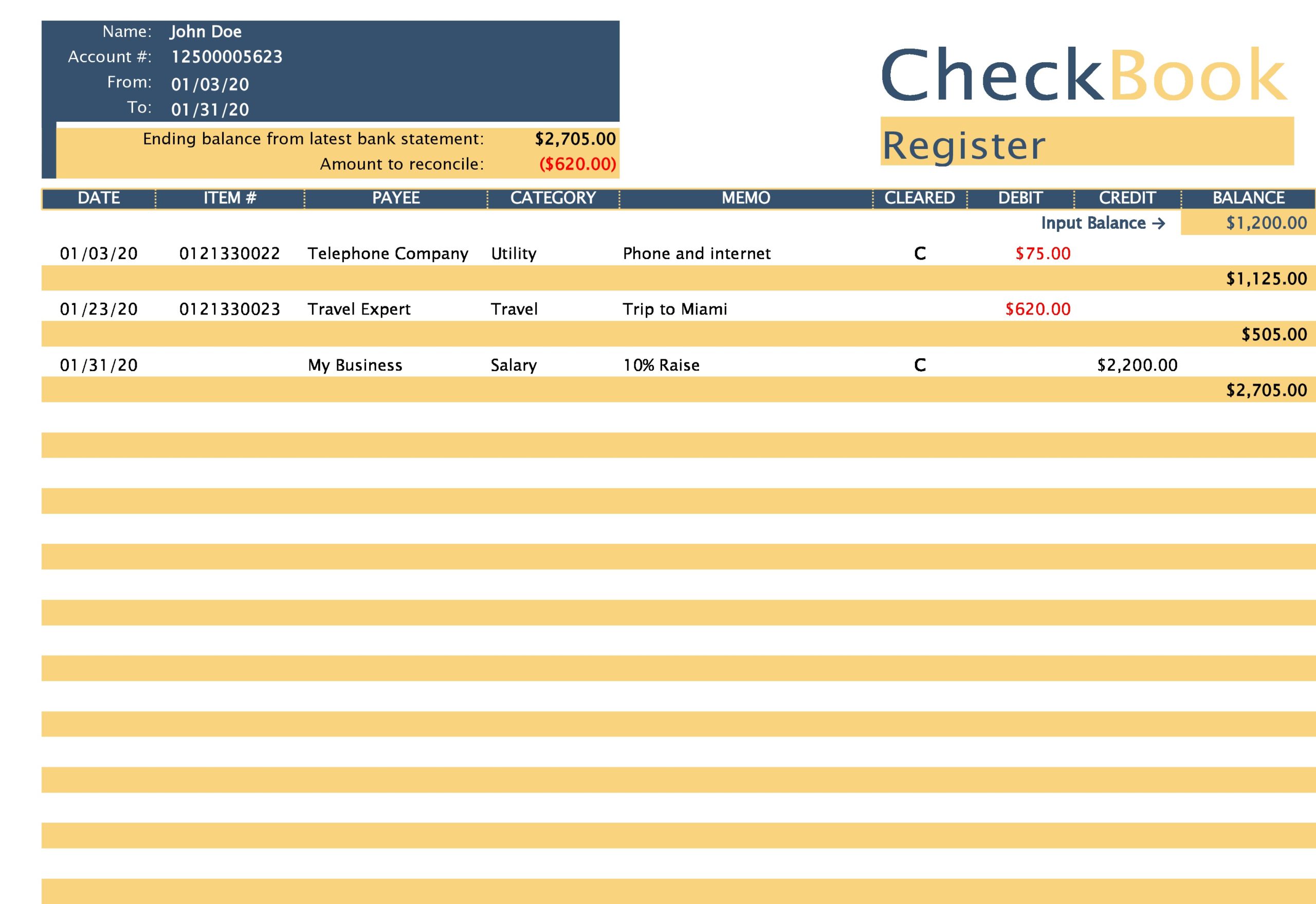

1. Determine your specific requirements: Before customizing your checkbook register, identify your specific needs and preferences. Consider the information you want to track, such as date, check number, payee, description, amount, and balance.

2. Choose a format: Decide on the format that works best for you. You can opt for a simple layout with basic columns or a more detailed format with additional columns for specific categories.

3. Add or remove columns: Customize the register by adding or removing columns based on your needs. For example, you can add columns for different income sources or expense categories to track them separately.

4. Modify fonts and formatting: Personalize the appearance of your checkbook register by changing fonts, font sizes, and formatting options. This can make the register more visually appealing and easier to read.

5. Include additional information: If there are specific details you want to record, such as account numbers or payment methods, you can add extra rows or columns to capture this information.

Benefits of customizing the register to fit individual needs

1. Enhanced organization: By customizing your checkbook register, you can arrange the information in a way that makes sense to you. This can help you stay organized and easily locate the data you need.

2. Improved tracking: Personalizing the register allows you to track your finances more effectively. You can tailor it to match your spending habits and financial goals, making it easier to monitor your income and expenses.

3. Simplified analysis: Customizing the register enables you to analyze your financial data more efficiently. You can create specific categories or sections to assess your spending patterns and identify areas where you can make adjustments or savings.

4. Increased motivation: When your checkbook register reflects your personal preferences and goals, you may feel more motivated to use it regularly. This can lead to better financial habits and a more proactive approach to managing your money.

Examples of customization options

Here are a few examples of customization options you can consider when personalizing a checkbook register:

- Add additional columns for different income sources or expense categories.

- Include a column for tracking tax-deductible expenses.

- Add rows for recording account numbers or payment methods.

- Change fonts, font sizes, or formatting to improve readability.

- Create separate sections for tracking savings or investments.

Integrating a free printable checkbook register with digital tools

Integrating a free printable checkbook register with digital tools allows you to leverage the benefits of both manual tracking and digital automation. By using printable registers alongside digital finance apps or software, you can have a more comprehensive view of your finances and ensure accurate record-keeping.

Using printable registers alongside digital finance apps or software

To integrate a free printable checkbook register with digital tools, follow these steps:

- Start by printing out a blank checkbook register template. You can find various designs and formats online.

- Keep the printed register handy and accessible, such as in a folder or binder, so you can easily update it whenever you make financial transactions.

- Download a finance app or use a digital software program to track your transactions electronically.

- Whenever you make a transaction, whether it’s writing a check, making a payment online, or using your debit card, record the details in both the printable register and the digital tool.

- Regularly reconcile the transactions recorded in the printable register with the ones in the digital tool to ensure accuracy.

Tips for syncing transactions between digital tools and the register

To ensure seamless syncing between your printable register and digital tools, consider the following tips:

- Choose a digital tool that allows you to export transaction data in a compatible format, such as CSV or Excel.

- Regularly export transaction data from the digital tool and import it into the printable register. This will help you keep the two records consistent.

- Make sure to update both the printable register and the digital tool in real-time or as soon as possible after a transaction occurs. This will minimize the risk of discrepancies.

- If you notice any discrepancies between the printable register and the digital tool, investigate and correct them promptly to maintain accurate financial records.

Advantages of using both printable and digital methods for tracking finances

Integrating a free printable checkbook register with digital tools offers several advantages:

- Enhanced accuracy: By cross-referencing your transactions in both the printable register and the digital tool, you can minimize errors and ensure precise record-keeping.

- Backup and security: While the digital tool provides automatic backups and data security, the printable register serves as a physical backup in case of technological failures or data loss.

- Customization: Printable registers can be customized according to your preferences, allowing you to organize and categorize your transactions in a way that suits your financial management style.

- Visual representation: Printable registers provide a visual representation of your financial transactions, making it easier to analyze your spending patterns and identify areas where you can make improvements.

Best practices for maintaining a free printable checkbook register

Regular maintenance and review of your checkbook register is essential to ensure accurate financial record-keeping. By following these best practices, you can effectively manage your finances and avoid any discrepancies or errors in your register.

Importance of regular maintenance and review

Regularly maintaining and reviewing your checkbook register allows you to:

- Keep track of your expenses and income accurately

- Identify any errors or discrepancies

- Monitor your spending habits

- Prevent overdrawing your account

It is recommended to dedicate a specific time each month to update and review your checkbook register, ensuring that all transactions are accurately recorded.

Reconciling the register with bank statements

To reconcile your checkbook register with your bank statements, follow these steps:

- Start by comparing the ending balance in your bank statement with the balance in your checkbook register.

- Check off each transaction that appears in your bank statement and mark it as cleared in your register.

- Note any transactions in your bank statement that are not in your register and add them to your register.

- Look for any discrepancies between the two balances and investigate any outstanding checks or deposits.

- Ensure that the ending balance in your register matches the ending balance in your bank statement.

By regularly reconciling your register with your bank statements, you can catch any errors or fraudulent activities and maintain an accurate record of your finances.

Strategies for troubleshooting errors or discrepancies

If you encounter errors or discrepancies in your checkbook register, consider the following strategies:

- Double-check your calculations and ensure that all transactions are accurately recorded.

- Contact your bank to verify any suspicious transactions or to resolve any discrepancies.

- Review your receipts, statements, and cancelled checks to identify any missing or incorrectly recorded transactions.

- Consider using online banking tools or financial management software to automate and streamline the process, minimizing the chances of errors.

- Seek help from a financial advisor or accountant for guidance on resolving complex discrepancies.

By implementing these strategies, you can effectively troubleshoot and resolve any errors or discrepancies in your checkbook register, ensuring the accuracy of your financial records.